After much talk, planning and complaints, the new Land and Buildings tax in Thailand went into effect last year. However, 2020 will be the first year property owners will pay tax under the new law. In terms of residential real estate, the main changes come in regard to ultra-luxury properties and the tax rate on additional residential units owned by a single individual. With that in mind, here are a few things you should know.

1) Most people won’t be impacted

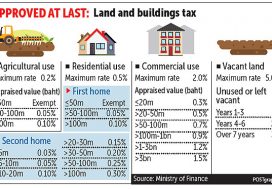

The new Land and Buildings tax in Thailand is targeting owners of luxury properties as well as individuals who own multiple residential units. To that end, individuals who own a single residential property priced less than THB50 million are exempt from the new tax. Additionally, vacant properties priced at THB10 million or less are exempt from the tax, but more on that a little later.

Those who own an ultra-luxury residence valued between THB50 and THB75 million fall in the 0.03 percent tax bracket while THB75 and THB100 million units are taxed at 0.05 percent and anything over that is subject to a 0.1 percent tax.

2) Multiple unit owners need to prepare

If you own more than one residential property, you can expect to pay tax on it as part of the new Land and Buildings tax in Thailand. Any additional property owned by a person valued at THB50 million or below is taxed at 0.02 percent. Anything greater than that value is taxed at the ultra-luxury residence rate listed above.

3) Vacant units to be taxed

Those in possession of a vacant residential property may be subject to paying under the new Land and Buildings tax in Thailand. Vacant units valued at THB10 million or less are exempt from the tax as long as the individual does not own more than one unit. Empty properties valued between THB10 and THB50 million are taxed at 0.02 percent with the rate increasing from there.

It is important to note that vacant properties valued at THB10 million or less are not exempt from the tax if they count as an additional unit. If a person already owns a unit, all empty properties are taxed at the additional property rate.

4) Transition period in effect

Owners don’t have to fret about paying more in property taxes just yet. The new Land and Buildings tax in Thailand contains a transition period of three years where property owners are eligible to pay what they would owe under the old House and Land tax plus an additional fee which increases by each year. This is only available if the tax assessed under the new law is greater than the old law. After the third year, the property owner is subject to paying the new tax regardless.

5) Talk to a professional if you’re unsure

While every homeowner has been mailed out information, in Thai, about the new Land and Buildings tax in Thailand, you may still have questions that need answering. Given the nature of the new tax, if you are unsure about your new responsibilities or require clarification, it is best to speak to a legal professional who can help you understand the big picture and provide a full range of options.

Source: Dotproperty / Thailand Property

WhatsApp us

WhatsApp us