The new land and buildings tax will force homeowners to reduce residential units being held and shift housing development to larger units, as only principal homes will be exempted.

Chinapat Visuttipat, founder and partner of legal firm One Law Office, said homeowners possessing a lot of houses will reduce the number of units they hold to reduce their tax burden.

“The new land and buildings tax will change behaviour among residence owners,” he said. “Those having many units will sell their properties in order to buy larger ones. The second-hand home market will be larger after this tax law is effective.”

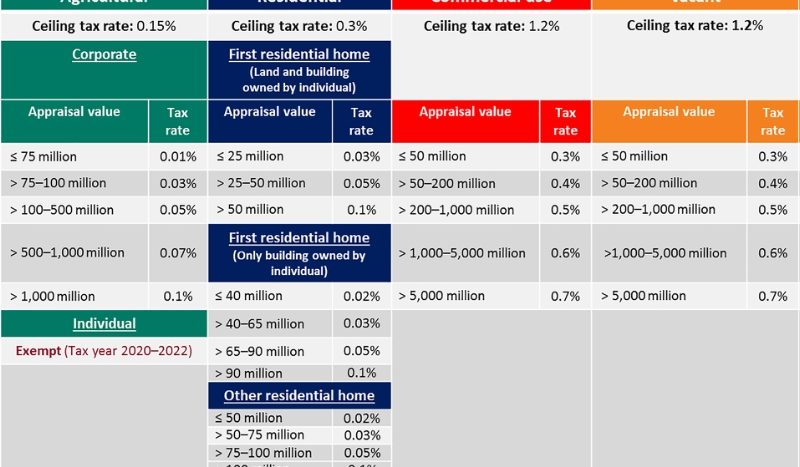

According to the new land and buildings tax, which took effect on March 12, 2019 but was postponed to this year, principal homes with appraisal prices of up to 50 million baht are tax-exempt.

Those valued at 50-75 million baht are taxed at 0.03% of appraisal price, 75-100 million baht at 0.05% and more than 100 million baht at 0.1%.

Those who only own houses, not land, qualify for a tax exemption for the first 10 million baht of their home’s appraisal price.

If owners have more than one home, the second and subsequent residences are subject to a 0.02% tax for those with an appraisal price of up to 50 million baht, and the same tax rate as principal homes is applied for those with appraisal prices above 50 million baht.

Mr Chinapat said the new land and buildings tax will stimulate housing developers to supply larger houses in accordance with the shift in home demand that will come about.

Two condo units combined as one will be regarded as two units, one of which will be a principal home and the other being taxed as the second, because they will be regarded as two units by the law, he said.

As some secondary laws, such as those related to agricultural land, are not applicable, Mr Chinapat suggested property owners examine, survey and manage their lands and properties.

“After surveying properties, owners should categorise them into four groups, comprising property to be held for at least 100 years, those to sell, those to wait for development and those to divide into inheritances,” he said. “Tax payments can categorised under a company’s expenses, but assets held by individuals cannot do the same.

“When an individual passes away, the property will be subject to inheritance tax, which is very high as property values rise every year.”

Source: Bangkok Post & CBRE

WhatsApp us

WhatsApp us