According to a visualization of recent UN World Tourism Organisation data by HowMuch, a financial literacy and infographics agency, Thailand outranks every other nation in Asia when it comes to tourism spend.

Last year, it collected US$57 billion in international tourism receipts, nearly doubling Macao (US$36 billion), Japan (US$34 billion), Hong Kong (US$33 billion), and China (US$33 billion).

Globally, the only countries that out-earn Thailand in terms of tourism dollars are France (US$61 billion), Spain (US$68 billion), and the United States—which handily takes the gold medal, at US$211 billion.

It all comes down to volume. Foreign arrivals could hit 40 million next year, which is more than half the country’s population.

“In Thailand, you’ve got something for everybody,” says Ms Rebecca Mazzaro, a specialist for bespoke outfitter ATJ.

“From the private island with the private villa to amazing street food meals that only cost a couple bucks, it has a diversity and variety that exists in few other markets. It’s no surprise lots of people are going—and spending,” she says.

A COMING LUXURY BLOOM

Though gaps in the WTO’s data make it difficult to ascertain the per-visitor spend in each of these countries, given recent and forthcoming developments, that number is likely to be rising.

“There’s no question that historically Bangkok—and Thailand in general—has always been perceived as a value destination,” says Mr John Blanco, general manager of the forthcoming five-star Capella Bangkok, opening next spring with 101 suites facing the Chao Phraya River. “But there has been a real effort to shift that perception.”

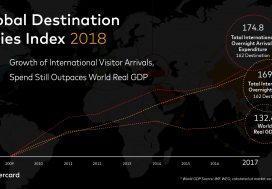

Mastercard’s annual Global Destination Cities Index recently ranked Bangkok as the most-visited city in 2017 for the third year in a row.

The study, based on undisclosed public data sources, rather than cardholder transactions, indicates that travellers shell out US$173 for a day in the Thai capital, compared to US$537 in Dubai or US$286 in Singapore. This year, it forecasts travellers will spend an additional 14 per cent more.

By next year, the city will have gained even more opportunities to spend, such as superlative new resorts from Four Seasons, Rosewood, Mandarin Oriental, and Waldorf Astoria, plus a US$1.6 billion Bal Harbour-esque mixed-use retail development called Icon Siam.

When it opens in November, the latter will claim restaurants from top-tier chefs, including Alain Ducasse and an outpost of Tokyo department store Takashimaya. The Capella hotel will house Mauro Colagreco restaurant, whose Mirazur in Menton, France, has two Michelin stars.

“There’s a lot more meat on the bone now,” Mr Blanco says of luxury offerings in the capital.

Mr Dino Michael, global head of Waldorf Astoria Hotels and Resorts, agrees.

“We’ve been noticing the upscaling of Bangkok for a few years,” he tells Bloomberg. “The consumer has become more sophisticated; the dining scene has become more sophisticated.”

And yet the timeless appeal is what led him to open the brand’s first southeast Asia property here in August — a glassy tower with dramatic skyline views from nearly every angle. Among Bangkok’s selling points, he says, are strong infrastructure and airlift, a “depth and breadth of tourists”, and an ingrained culture of hospitality.

For tourists and brands thinking about charting the region, Mr Michael adds, “It’s world renown—and an obvious starting point.”

PITFALLS OF POPULARITY

There may be a price to pay for popularity, particularly on Thailand’s beaches and islands.

Already, throngs of partygoers on commercial yachts have done so much damage to the pristine marine ecosystem of Maya Bay—the picturesque backdrop to Leonardo DiCaprio’s 2000 film The Beach—that the area closed for four months earlier this year to recover.

Unable to bounce back fast enough, it’s now being closed indefinitely. That follows similar measures in nearby Koh Khai and Koh Tachai islands, where coral was being destroyed at devastating rates.

In Phuket, Mastercard’s 12th-most-visited destination in the world, there’s been a sharp decline in the local turtle population, correlated with the rise in beachside pollution.

It’s led 70 hoteliers to band together to promote sustainability and encourage better etiquette among travellers.

And in Thailand’s north, the dramatic growth of tourism has led to a sobering spike in unethical wildlife tourism, often centering around elephants and tigers.

The capital, meanwhile, has stayed largely out of the way of these visitor-related troubles—perhaps because it’s hard(er) to justify bad behaviour in a city with 40,000 Buddhist temples.

“Of course, red light tourism is alive and well—like it or not,” says Ms Catherine Heald, founder and chief executive of Asia outfitter Remote Lands.

“But ultimately, tourism has really lifted the local economy.” At US$57 billion a year, there’s no denying that.

Article brought to you by 88Property.com

Source: TODAYONLINE / BLOOMBERG

WhatsApp us

WhatsApp us